PARIS — In the summer of 1996 two U.S. defense industry chieftains met at a Bethesda, Md., diner — just the two of them, no lawyers or investment bankers in sight — and agreed that one would sell its defense division to the other for $9 billion.

The purchase of Loral’s defense business by Lockheed Martin made Loral shareholders a bundle, turned out OK for Lockheed as well and allowed Loral to focus exclusively on the satellite industry as Loral Space & Communications.

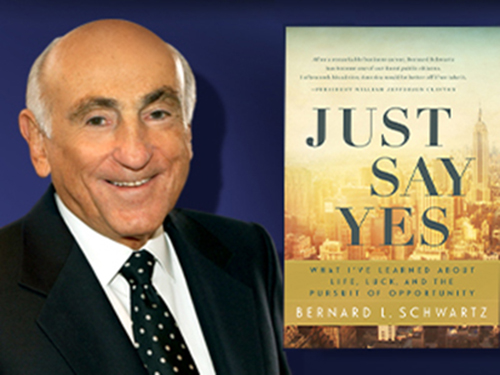

But as retired Loral Chief Executive Bernard L. Schwartz tells it in his forthcoming autobiography, “Just Say Yes,” the key to the transaction was not just the price, which he said was fair and nonnegotiable, but the person: He wanted the Loral division’s employees to be moving to Lockheed because he liked the way Lockheed Chief Executive Norman Augustine did business and treated his people.

Without Augustine’s presence, Schwartz says in the book, to be released March 28 by Greenleaf Book Group Press, there would have been no deal. He would pitch Loral’s defense arm to no one else.

A year later, Augustine was retiring and the new Lockheed chief executive, Dan Tellep, announced plans to reorganize the company, doing away with the new electronics division and merging it into another Lockheed business. The reorganization would remove former Loral President Frank Lanza from his new job at Lockheed.

This was no longer a money issue for Schwartz. But instead of washing his hands of it, he went to Jack Welch, then General Electric chief executive — GE was a big Lockheed shareholder — to ask that he intercede. Several days later, Lockheed reversed its decision and kept the defense electronics business organization as agreed to by Schwartz and Augustine.

A livid Tellep accused Schwartz of being disloyal for discussing company business with outsiders, and said he would never speak to Schwartz again. According to Schwartz, he kept his word.

If there is a theme to “Just Say Yes,” it may be this: You can make a killing and use a moral compass at the same time.

Schwartz’s period at Loral — he retired in February 2006 — was highlighted by two storms that blew through the company. One involved the sale of satellites to China, and the other was the consequence of Loral’s development of the Globalstar mobile satellite services company. These two chapters in Schwartz’s autobiography are excerpted in Commentary on page 25.

Loral’s sale of the ChinaSat-8 telecommunications satellite to China, and Loral’s involvement in an investigation into a 1996 Chinese rocket failure that destroyed an Intelsat satellite, were transformed by a hyperventilating U.S. press and U.S. Congress into a uniquely Washington-type scandal.

Schwartz recalls being labeled a “pinko” by a U.S. congressman and a “traitor” at a Hamptons cocktail party for Loral’s dealings with China.

The U.S. State Department sat on Loral’s request to ship ChinaSat-8, for which the Chinese had paid, in advance, the full $250 million construction cost. The export license never arrived, and Loral subsequently refitted the satellite and sold it to a non-Chinese operator.

“Hearing my name associated with espionage or anti-Americanism felt surreal,” Schwartz writes.

By 2001, Loral’s business as a mainly commercial satellite manufacturer with few government contracts ran into the bursting of the global telecommunications bubble and the drying up of new commercial satellite orders. At the same time, Loral’s creation, the Globalstar mobile satellite services business, was suffering cost overruns and the aftereffects of a launch failure that destroyed 12 Globalstar satellites. The weakened Loral, heavily invested in Globalstar, became a potential target.

Globalstar threatened to pull Loral with it into Chapter 11 bankruptcy. Despite Schwartz’s efforts, this is what happened, leaving one bondholder, Mark H. Rachesky, the new owner of a substantial share of Loral equity.

Schwartz says he pegged Rachesky from the start as “a classic corporate raider” more interested in forcing target companies into bankruptcy and then stripping them of assets than running and growing businesses.

Schwartz was determined to emerge from Chapter 11 by paying all Loral’s debts. Rachesky, he says, wanted to pay creditors pennies on the dollar and even raid Loral’s pension fund to do so. Schwartz refused, saying the proposal “defied common decency.”

Rachesky is now chairman of Loral, which in 2012 sold the satellite building business, Space Systems/Loral, to MDA Corp. of Canada.

Among his regrets, Schwartz says, is that “I did not, because of circumstances beyond my control, leave the chairmanship in very good hands.”

Follow Peter on Twitter: @pbdes

Related

ncG1vNJzZmiroJawprrEsKpnm5%2BifHSFlmlopaeilrlusMSao6xllJ65prnMmqpmnJWprqq4xJ1koqZdp7K1tdGem2abmJ6yp7%2BMmqytp5KevKi%2BwKmfsmc%3D